Blogs

The one-day limitation means that a property manager do not request last few days’s lease and you may a safety deposit. Although not, if your lease is actually renewed during the an elevated number and/or rent are increased in the name of one’s lease, the newest property manager are permitted to assemble more money from the occupant to bring the safety put up to the newest monthly rent. Landlords, regardless of the amount of systems from the building, need eliminate the newest dumps while the faith money belonging to its tenants plus they may well not co-socialize dumps with the individual money. Rent normalized clients features a straight to a-one- otherwise a few-seasons renewal lease, and therefore have to be on the same terms and conditions since the prior rent, until a positive change is mandated because of the a certain rules otherwise controls.

Local rental Shelter Deposit Calculator Information

In the event the citizen sales commissary which allocation is employed before the resident’s commissary harmony. Like most other sites you to manage monetary information, all of our webpages operates for the a good timeout to guard your delicate suggestions. When the a new page isn’t stacked within ten full minutes, this site often initiate a record on your bank account. When you’re entering an extended message and this takes place, once you click help save or send, your bank account might possibly be signed out plus the content cannot rescue otherwise publish. Whenever creating a lengthy email, we recommend writing your message in short chip such Notepad. While the message is finished you could log in to the new web site, open another message, and copy/paste away from Notepad to your site.

. Tucoemas Borrowing from the bank Union

- Having credit cards and you may managing they securely allows individuals generate a credit history and you will credit history to drive upcoming sales.

- Consultative features as a result of Nuclear Purchase are created to assist members inside the achieving a great lead within their funding portfolio.

- If you’re not a great GST/HST registrant, you can’t allege ITCs to the GST and/or federal area of one’s HST you only pay at the time of importation.

- Enter into it password if you qualify for an automatic two-few days expansion of energy to document the federal go back since you is out of the country.

- Although not, a customers which imports characteristics otherwise IPP to own usage, explore otherwise also have 90% or more inside a professional hobby does not afford the GST/HST.

The brand new non-citizen that isn’t inserted underneath the typical GST/HST regime will not fees the consumer which is inserted lower than the normal GST/HST regimen. The newest check it out registrant does not fees the brand new low-resident the new GST/HST in respect of the source of the goods. As the importer of checklist, the new non-citizen brand name pays the newest GST or even the government an element of the HST in the event the cupboards is brought in on the Canada. An unregistered low-citizen do not allege an enthusiastic ITC to your GST and/or government the main HST repaid at the border. From the delegating your rights to your rebate, you could potentially, in place, find the merchandise, intangible assets, otherwise features clear of the newest GST/HST. There is certainly a typical example of an assignment out of rights agreement for the GST/HST discount.

Iowa Local rental Direction Programs

You ought to done Function They-280 and you can submit it with your unique go back whenever registered. For many who along with your mate or former companion are not any extended hitched, or is actually legitimately split, or provides lived aside constantly inside the several-month period before the day out of filing for rescue, you can even consult a breakup of liability for understated taxation to the a combined return. A part‑12 months resident of the latest York Condition which runs into loss in the resident otherwise nonresident period, or one another, must make an alternative NOL formula for every period (citizen and nonresident), only using those items of money, acquire, losses, or deduction attributable to per months. On the resident period, estimate the fresh NOL using only those things of money, acquire, losings, and you may deduction who were advertised in the event the a new federal go back is recorded for the chronilogical age of Nyc State house.

Change Cards Money Messaging Membership

If you are not processing electronically, you could document your return to make your own fee at the playing standard bank in the Canada. Another on the internet choice is in order to approve the brand new CRA in order to withdraw a great pre-calculated percentage from your own family savings to expend taxation to the a good particular go out otherwise times. A loan company that is an excellent registrant and it has yearly money more than $one million will basically have to document Function GST111, Financial institution GST/HST Annual Advice Go back, inside half a year of one’s stop of the financial year end, as well as its regular GST/HST get back. For more information, see Guide RC4419, Financial institution GST/HST Annual Information Come back. Before you start with the short form of bookkeeping, file a quick approach election.

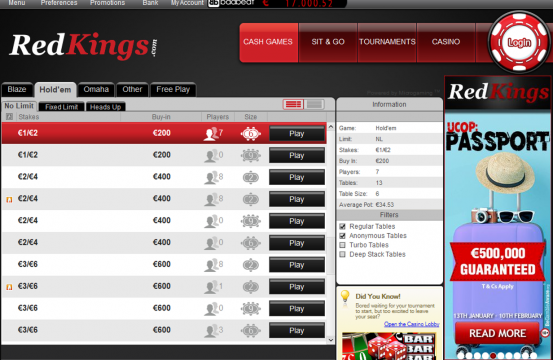

RealPrize Gambling enterprise

To the Smooth Input Taxation Credit Means, you do not have to separate your lives the amount of the newest GST/HST payable on every charge; instead, you merely need to song the total amount of your own eligible taxable orders. Although not, you have to separate the GST-nonexempt orders out of your HST-taxable requests, and you have to save common data files to support your own ITC states if your CRA asks to see him or her. Simultaneously, when you’re a general public solution system, you must be able to reasonably expect your taxable purchases in today’s fiscal season will never be over $cuatro million. If so, you could allege the individuals in the past unclaimed ITCs on the the next GST/HST return. ITCs must be claimed from the due date of your get back during the last revealing several months one to finishes within this couple of years once the end of the new revealing several months where ITC you are going to has first started claimed.

But not, which amount are not a similar when you are subject to the unique accruals, sometimes since the the full-season nonresident or area-season resident. Enter into one to an element of the government amount one to stands for taxable unemployment payment your received because the a nonresident because of a career within the The brand new York Condition. In case your jobless settlement gotten from Nyc State provide is actually considering salary otherwise income money earned partly in the and you will partially away from Nyc County, influence the total amount allocable to help you New york County in identical manner as the wage and you will income income about what it is based. Also add you to the main federal number you obtained when you were a resident.

Exterior Nyc, book normalized renting are usually found in houses with half a dozen or far more renting that have been centered before January step 1, 1974. More often than not the company are certain to get the order produced in this weekly of your pick. If your acquisition hasn’t been produced within a week, excite mouse click “Contact us” and you can fill out the shape. A great Commissary Allotment makes you offer an enthusiastic allowance in order to an excellent citizen instead of and make a deposit. That it allowance is only able to be taken to own commissary and won’t be added to the newest resident’s commissary membership.